News

Murphy Oil Announces Fourth Quarter Financial Results

HOUSTON – Murphy Oil Corporation (NYSE: MUR) today announced its financial and operating results for the fourth quarter ended December 31, 2024, including net income attributable to Murphy of $50 million, or $0.34 net income per diluted share. Excluding discontinued operations and other items affecting comparability between periods, adjusted net income attributable to Murphy was $51 million, or $0.35 adjusted net income per diluted share.

For full year 2024, the company recorded net income attributable to Murphy of $407 million, or $2.70 net income per diluted share. Murphy reported adjusted net income, which excludes both the results of discontinued operations and other items affecting comparability between periods, of $417 million, or $2.76 adjusted net income per diluted share.

Unless otherwise noted, the financial and operating highlights and metrics discussed in this commentary exclude noncontrolling interest (NCI). 1

Highlights for the fourth quarter include:

- Drilled an oil discovery at Hai Su Vang-1X in offshore Vietnam and encountered approximately 370 feet of net oil pay from two reservoirs

- Commenced LDV-A platform construction and executed the contract for the floating storage and offloading vessel for the Lac Da Vang field development project in Vietnam

- Upsized new five-year senior unsecured credit facility to $1.35 billion, significantly enhancing liquidity with a nearly 70 percent increase from previous facility

- Issued $600 million aggregate principal amount of 6.000 percent senior notes due 2032, and redeemed a total $600 million of senior notes due 2027, 2028 and 2029

- Recorded lowest net debt in over a decade at approximately $850 million

- Completed seismic reprocessing for Côte d’Ivoire

Highlights for full year 2024 include:

- Achieved lowest Total Recordable Incident Rate since 2016

- Entered Murphy 3.0 of capital allocation framework, repurchased $300 million of stock or 8.0 million shares, and repurchased $50 million of senior notes

- Recorded lowest annual selling and general expense since 2002 at $108 million

- Achieved record high peak gross production rate of 496 million cubic feet per day (MMCFD) in Tupper Montney, effectively reaching processing plant capacity

- Drilled a discovery at the non-operated Ocotillo #1 exploration well in Mississippi Canyon 40 in the Gulf of Mexico

- Awarded six deepwater blocks from Gulf of Mexico Federal Lease Sale 261

Subsequent to the fourth quarter:

- Announced an additional 8 percent increase of the quarterly cash dividend to $0.325 per share, or $1.30 per share annualized for 2025

“I am pleased that in 2024, we continued to focus on our priorities of Delever, Execute, Explore and Return. As a result, we achieved Murphy 3.0 of our capital allocation framework, strengthened our balance sheet, increased our liquidity, made two impactful discoveries and advanced our Lac Da Vang field development project in Vietnam,” said Eric M. Hambly, President and Chief Executive Officer. “Our discoveries at Hai Su Vang-1X in Vietnam and non-operated Ocotillo #1 in the Gulf of Mexico demonstrate our commitment to organically creating shareholder value and increasing our resource potential. These opportunities, alongside our existing portfolio, provide multi-basin optionality as we strive to remain an industry leader for decades to come. In 2025, we are looking forward to drilling multiple exploration prospects in the Gulf of Mexico, Vietnam and Côte d’Ivoire, and continually rewarding shareholders with our long-standing dividend and further share repurchases.”

FOURTH QUARTER 2024 RESULTS

The company recorded net income attributable to Murphy of $50 million, or $0.34 net income per diluted share, for the fourth quarter 2024. Adjusted net income, which excludes both the results of discontinued operations and certain other items that affect comparability of results between periods, was $51 million, or $0.35 per diluted share for the same period. Details for fourth quarter results and an adjusted net income reconciliation can be found in the attached schedules.

Earnings before interest, taxes, depreciation and amortization (EBITDA) attributable to Murphy were $315 million. Earnings before interest, tax, depreciation, amortization and exploration expenses (EBITDAX) attributable to Murphy were $330 million. Adjusted EBITDA attributable to Murphy was $321 million. Adjusted EBITDAX attributable to Murphy was $337 million. Reconciliations for fourth quarter EBITDA, EBITDAX, adjusted EBITDA and adjusted EBITDAX can be found in the attached schedules.

Fourth quarter production averaged 175 thousand barrels of oil equivalent per day (MBOEPD), which included 85 thousand barrels of oil per day (MBOPD). Production impacts of 10.8 MBOEPD were mostly attributed to:

- 5.6 MBOEPD of unplanned downtime across operated assets, including 1.8 MBOEPD due to a mechanical issue at a Khaleesi well, 1.4 MBOEPD for an offshore rig delay for the Samurai #3 well workover in the Gulf of Mexico, and 2.4 MBOEPD for other onshore and offshore assets;

- 2.8 MBOEPD of unplanned downtime across non-operated assets, including 2.4 MBOEPD for offshore weather impacts;

- 1.9 MBOEPD of lower performance as a result of a revised Eagle Ford Shale completion design on a four-well Catarina pad that was less successful than anticipated; and

- 0.5 MBOEPD due to a timing delay in the Mormont #4 (Green Canyon 478) well as a result of evaluating and completing additional pay.

Accrued capital expenditures (CAPEX) for fourth quarter 2024 totaled $186 million, excluding NCI. Details for fourth quarter production and CAPEX can be found in the attached schedules.

FULL YEAR 2024 RESULTS

The company recorded net income attributable to Murphy of $407 million, or $2.70 net income per diluted share, for full year 2024. Adjusted net income, which excludes both the results of discontinued operations and certain other items that affect comparability of results between periods, was $417 million, or $2.76 per diluted share for the same period. Details for full year 2024 results and an adjusted net income reconciliation can be found in the attached schedules.

EBITDA attributable to Murphy was $1.4 billion. EBITDAX attributable to Murphy was $1.6 billion. Adjusted EBITDA attributable to Murphy was $1.5 billion. Adjusted EBITDAX attributable to Murphy was $1.6 billion. Reconciliations for full year 2024 EBITDA, EBITDAX, adjusted EBITDA and adjusted EBITDAX can be found in the attached schedules.

Production for full year 2024 averaged 177 MBOEPD, which included 88 MBOPD. Accrued CAPEX for full year 2024 totaled $953 million, excluding NCI. Details for full year 2024 production and CAPEX can be found in the attached schedules.

CAPITAL ALLOCATION FRAMEWORK

Share Repurchases

In 2024, Murphy repurchased $300 million of stock, or 8.0 million shares. Murphy did not repurchase any shares in the fourth quarter. The company had $650 million remaining under its share repurchase authorization and 145.8 million shares outstanding as of December 31, 2024.

FINANCIAL POSITION

As previously announced, in the fourth quarter Murphy issued $600 million of 6.000 percent senior notes due 2032 and redeemed a total $600 million of senior notes, comprised of $338 million of senior notes due 2027, $200 million of senior notes due 2028 and $62 million of senior notes due 2029.

Also in the fourth quarter, Murphy entered into a new five-year senior unsecured credit facility, with a total facility size of $1.35 billion as of December 31, 2024. This represents a nearly 70 percent increase from the previous credit facility.

Murphy had approximately $1.8 billion of liquidity on December 31, 2024, with no borrowings on the $1.35 billion senior unsecured credit facility and $424 million of cash and cash equivalents, inclusive of NCI.

As of December 31, 2024, Murphy’s total debt of $1.27 billion was comprised of long-term, fixed-rate notes with a weighted average maturity of 9.4 years and a weighted average coupon of 6.1 percent.

“We executed a series of debt transactions during the fourth quarter to extend our maturity profile by two years, and I am excited at the 6.000 percent rate we received on our new 2032 senior notes. More importantly, our bank group remained supportive of Murphy as we strive to achieve investment grade, and we established a new credit facility with nearly 70 percent more liquidity than our previous facility,” said Thomas J. Mireles, Executive Vice President and Chief Financial Officer. “Through our focus on delevering, we have achieved our lowest net debt in over a decade at approximately $850 million, with a strong net debt to total capital ratio of only 13 percent. This solid balance sheet positions us well to capitalize on future opportunities.”

YEAR-END 2024 PROVED RESERVES

After producing 65 MMBOE for the year, Murphy’s preliminary year-end 2024 proved reserves were 713 MMBOE, consisting of 37 percent oil and 42 percent liquids. Total reserve replacement was 83 percent in 2024.

The company maintained a consistent reserve life of 11 years with 59 percent proved developed reserves.

|

|

2024 Proved Reserves – Preliminary * |

|||

|

Category |

Net Oil (MMBBL) |

Net NGLs (MMBBL) |

Net Gas |

Net Equiv. |

|

Proved Developed (PD) |

172 |

24 |

1,360 |

422 |

|

Proved Undeveloped (PUD) |

89 |

14 |

1,127 |

291 |

|

Total Proved |

261 |

38 |

2,487 |

713 |

|

* Proved reserves exclude NCI and are based on preliminary year-end 2024 third-party audited volumes using SEC pricing. |

||||

OPERATIONS SUMMARY

Onshore

In the fourth quarter of 2024, the onshore business produced approximately 100 MBOEPD, which included 29 percent liquids volumes.

Eagle Ford Shale – Production averaged 30 MBOEPD with 69 percent oil volumes and 85 percent liquids volumes in the fourth quarter. As planned, Murphy brought online four operated wells in Catarina during the quarter, and drilled six operated and one non-operated well in Karnes in preparation for its 2025 well delivery program.

Tupper Montney – During the fourth quarter, natural gas production averaged 387 MMCFD. As planned, Murphy drilled two operated wells during the quarter in preparation for its 2025 well delivery program.

Kaybob Duvernay – Production averaged 4 MBOEPD with 56 percent oil volumes and 71 percent liquids volumes in the fourth quarter.

Offshore

Excluding NCI, in the fourth quarter of 2024, the offshore business produced approximately 75 MBOEPD, which included 82 percent oil.

Gulf of Mexico – Production averaged approximately 68 MBOEPD, consisting of 80 percent oil during the fourth quarter. During the quarter, Murphy drilled and began completing the Mormont #4 (Green Canyon 478) well and progressed the Samurai #3 (Green Canyon 432) well workover.

Also during the quarter, Murphy sanctioned the non-operated Zephyrus development project in the Gulf of Mexico in 2024, with targeted first oil in second half 2025.

Canada – In the fourth quarter, production averaged 7 MBOEPD, consisting of 100 percent oil.

Vietnam – During the fourth quarter, Murphy progressed the Lac Da Vang field development project by commencing construction of the LDV-A platform and executing the contract for the floating storage and offloading vessel.

EXPLORATION

Vietnam – As previously announced, during the fourth quarter Murphy drilled an oil discovery at the Hai Su Vang-1X exploration well in Block 15-2/17 in the Cuu Long Basin, located 40 miles offshore Vietnam. The well was drilled to total depth of 13,124 feet in 149 feet of water. Hai Su Vang-1X encountered approximately 370 feet of net oil pay from two reservoirs.

Murphy achieved a facility-constrained flow rate of 10,000 BOPD. Additional testing showed high-quality, 37-degree oil with a gas-oil ratio of approximately 1,100 standard cubic feet per barrel.

Murphy’s subsidiary, Murphy Cuu Long Tay Oil Co., Ltd., is the operator of the block with 40 percent working interest. PetroVietnam Exploration Production Corporation Ltd. holds 35 percent working interest and SK Earthon Co., Ltd. holds the remaining 25 percent.

Côte d’Ivoire – In the fourth quarter, Murphy received final seismic data and completed reprocessing in preparation for its upcoming three-well exploration drilling program.

2025 CAPITAL EXPENDITURE AND PRODUCTION GUIDANCE

The 2025 CAPEX plan is expected to be in the range of $1,135 million to $1,285 million. Full year 2025 production is expected to be in the range of 174.5 to 182.5 MBOEPD, consisting of approximately 91 MBOPD oil and 101 MBOEPD liquids volumes, equating to 51 percent oil and 57 percent liquids volumes, respectively.

Production for first quarter 2025 is estimated to be in the range of 159 to 167 MBOEPD with 83.5 MBOPD, or 51 percent, oil volumes. Production is impacted by 4.4 MBOEPD of planned operated onshore downtime and 2.9 MBOEPD of planned offshore downtime, primarily at non-operated assets. Both production and CAPEX guidance ranges exclude NCI.

|

2025 CAPEX by Quarter ($ MMs) |

||||

|

1Q 2025E |

2Q 2025E |

3Q 2025E |

4Q 2025E |

FY 2025E |

|

$425 |

$280 |

$275 |

$230 |

$1,210 |

Accrual CAPEX, based on midpoint of guidance range and excluding NCI.

The table below illustrates the capital allocation by area.

|

2025 Capital Expenditure Guidance |

||

|

Area |

Total CAPEX |

Percent of |

|

Offshore |

|

|

|

Gulf of Mexico |

$410 |

34 |

|

Hibernia / Terra Nova |

$20 |

2 |

|

Vietnam and Other |

$115 |

9 |

|

Exploration |

$145 |

12 |

|

Onshore |

|

|

|

Eagle Ford Shale |

$360 |

30 |

|

Kaybob Duvernay / Tupper Montney |

$140 |

11 |

|

Corporate |

$20 |

2 |

Offshore

Murphy has allocated approximately $410 million of its 2025 CAPEX to the Gulf of Mexico for operated and non-operated development drilling and field development projects.

Murphy plans to spend approximately $20 million of CAPEX in offshore Canada in 2025, with the majority designated for non-operated Hibernia development drilling.

Approximately $115 million of CAPEX has been allocated to Vietnam and other offshore operations in 2025. This includes $20 million for Lac Da Vang development drilling and $90 million designated for Lac Da Vang field development activities, with the remaining $5 million allocated to Paon field development in Côte d’Ivoire.

Exploration

The company has allocated approximately $145 million to its 2025 exploration program, which includes drilling two operated exploration wells in the Gulf of Mexico, one exploration well in Côte d’Ivoire, the Lac Da Hong-1X exploration well in Vietnam and a Hai Su Vang appraisal well in Vietnam.

“We have an ambitious exploration program ahead of us over the next 18 months, with operated wells planned in the Gulf of Mexico, Vietnam and Côte d’Ivoire, in addition to an appraisal well in Vietnam. This optionality across multiple play types in key basins provides significant resource upside for our offshore business. It is an exciting time at Murphy, and exploration will remain a key differentiator and value creator for our company for years to come,” said Hambly.

Onshore

Murphy plans to spend approximately $360 million of its 2025 CAPEX in the Eagle Ford Shale, with $275 million allocated to drill 34 and bring online 35 operated wells, as well as drill 24 and bring online 28 non-operated wells. The remaining $85 million will support field development.

Approximately $140 million of Murphy’s 2025 CAPEX is allocated to Canada onshore. The company plans to spend $65 million in the Tupper Montney to drill 8 and bring online 10 operated wells, with $50 million allocated in the Kaybob Duvernay to drill 6 and bring online 4 operated wells. The remaining $25 million is designated for field development in both areas.

The table below details the 2025 onshore well delivery plan by quarter.

|

2025 Onshore Wells Online |

|||||

|

|

1Q 2025 |

2Q 2025 |

3Q 2025 |

4Q 2025 |

2025 Total |

|

Eagle Ford Shale |

– |

21 |

14 |

– |

35 |

|

Kaybob Duvernay |

– |

– |

4 |

– |

4 |

|

Tupper Montney |

5 |

5 |

– |

– |

10 |

|

Non-Op Eagle Ford Shale |

1 |

11 |

4 |

12 |

28 |

Note: All well counts are shown gross. Eagle Ford Shale non-operated working interest averages 26 percent.

Detailed guidance for the first quarter and full year 2025 is contained in the attached schedules.

FIXED PRICE FORWARD SALES CONTRACTS

The company employs derivative commodity instruments to manage certain risks associated with commodity price volatility and underpin capital spending associated with certain assets. Murphy holds NYMEX natural gas swaps of 20 MMCFD of January 2025 production at an average price of $3.20 per thousand cubic feet (MCF), 40 MMCFD of February through June 2025 production at an average price of $3.58 per MCF, 60 MMCFD of third quarter 2025 production at an average price of $3.65 per MCF and 60 MMCFD of fourth quarter 2025 production at $3.74 per MCF.

Murphy also maintains fixed price forward sales contracts in Canada to mitigate volatility of AECO prices. These contracts are for physical delivery of natural gas volumes at a fixed price, with no mark-to-market income adjustments. Details for the current fixed price contracts can be found in the attached schedules.

CONFERENCE CALL AND WEBCAST SCHEDULED FOR JANUARY 30, 2025

Murphy will host a conference call to discuss fourth quarter 2024 financial and operating results on Thursday, January 30, 2025, at 9:00 a.m. EST. The call can be accessed either via the Internet through the events calendar on the Murphy Oil Corporation Investor Relations website at http://ir.murphyoilcorp.com or via telephone by dialing toll free 1-800-717-1738, reservation number 18687. For additional information, please refer to the Fourth Quarter 2024 Earnings Presentation available under the News and Events section of the Investor Relations website.

FINANCIAL DATA

Summary financial data and operating statistics for fourth quarter 2024, with comparisons to the same period from the previous year, are contained in the attached schedules. Additionally, a schedule indicating the impacts of items affecting comparability of results between periods, a reconciliation of EBITDA, EBITDAX, adjusted EBITDA and adjusted EBITDAX between periods, as well as guidance for the first quarter and full year 2025, are also included.

CAPITAL ALLOCATION FRAMEWORK

This news release contains references to the company’s capital allocation framework and adjusted free cash flow. As previously disclosed, Murphy now allocates capital pursuant to Murphy 3.0 of the company’s capital allocation framework, under which the company allocates a minimum of 50 percent of adjusted free cash flow to shareholder returns, primarily through buybacks. Murphy will continue to assess the appropriate shareholder return allocation under the framework, including potential dividend increases. The remainder of adjusted free cash flow will be allocated to the balance sheet as the company maintains the $1.0 billion total long-term debt goal.

Adjusted free cash flow is defined as cash flow from operations before working capital change, less capital expenditures, distributions to NCI and projected payments, quarterly dividend and accretive acquisitions.

ABOUT MURPHY OIL CORPORATION

As an independent oil and natural gas exploration and production company, Murphy Oil Corporation believes in providing energy that empowers people by doing right always, staying with it and thinking beyond possible. Murphy challenges the norm, taps into its strong legacy and uses its foresight and financial discipline to deliver inspired energy solutions. Murphy sees a future where it is an industry leader who is positively impacting lives for the next 100 years and beyond. Additional information can be found on the company’s website at www.murphyoilcorp.com.

News

Father Bob Allen Charitable Clinic announces new APRN

News

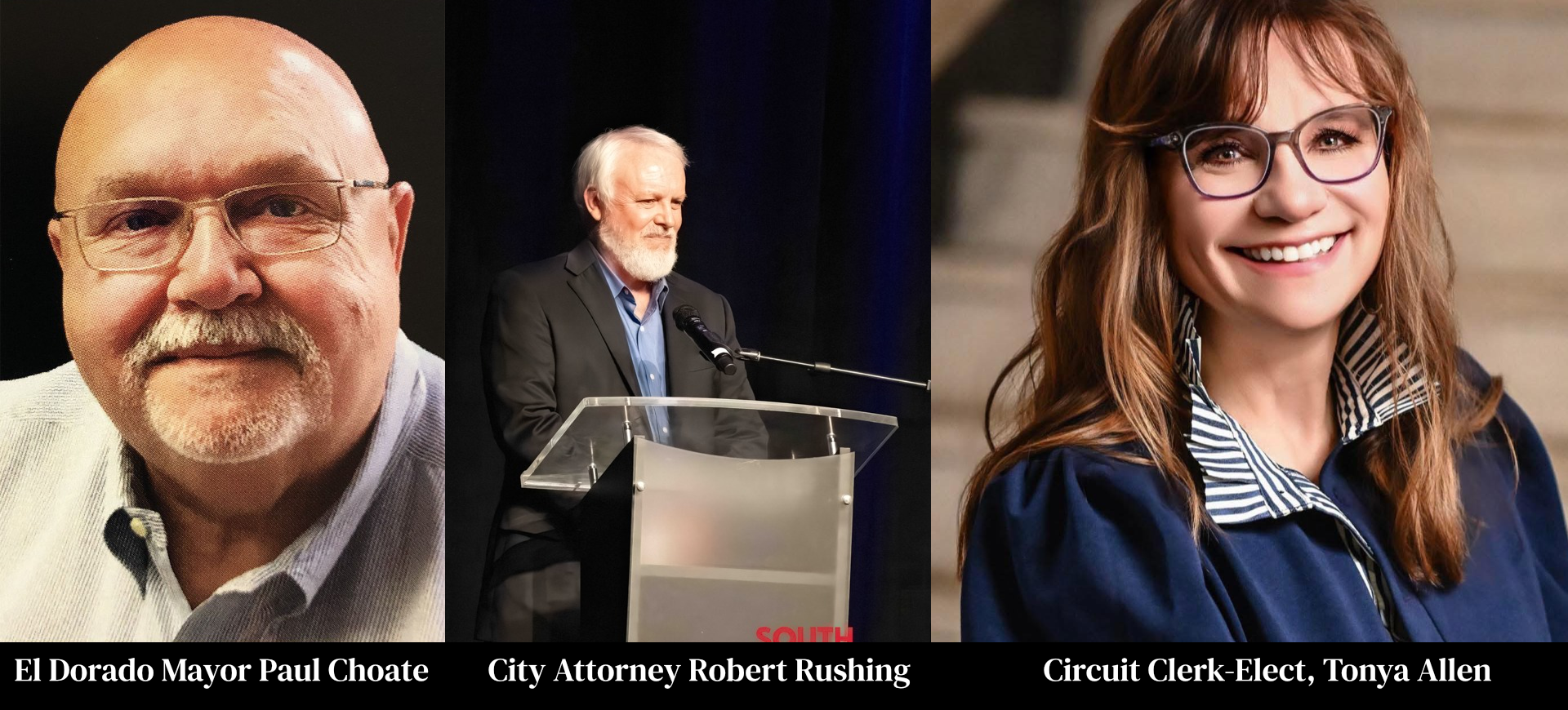

“CLOSE RACES” END AS LANDSLIDES

EL DORADO – South Arkansas Now spent the last two weeks speaking to people as they exited the early voting location at the El Dorado Municipal Auditorium. Those who spoke with us were promised three things: 1) We would not ask their name, 2) We would NOT ask them for whom they voted and 3) What were their predictions on certain races. The consensus among those we spoke with, leading up to yesterday’s tallying of the votes was, “It’s a toss-up!” “I’d say 50/50!” and one man suggested, “Flip a coin, that’s gonna be about as accurate as trying to predict it at this point.” Each participant said they knew who they voted for but had no idea how the rest of the city would vote.

You may be asking yourself, “Which race are you talking about?” Which is a very good question, because those responses above are all from three different races and yet were most answers we received when talking about 1) The Mayor’s Race, 2) City Attorney’s Race, and the 3) ½ cent sales tax. Prior to going live with last night’s coverage of election returns, B.A. “Sandy” Sanford, Grant Merrill and Jax Sanford all seemed to agree on one key point; it could be a long night if the votes are close.

However, once the totals began to roll in, it was anything but close in all three of those races. Mayor Paul Choate, who took office in 2023 after defeating previous Mayor Veronica Smith-Creer, was on the ballot with a Republican challenger in political newcomer Reko Roberson. Voters we spoke with seemed to expect a close race. However, Mayor Choate retained the nomination with 74% of the vote, a count of 875 to Roberson’s 307. Daniel Roberts, a political strategist with ties to Northwest Arkansas, Northeast Louisiana, and the DFW Metro said, “I only have limited knowledge of that race, but from what I saw, Roberson spent most of his time reaching out and trying to include people who were not likely to vote in the Republican primary. From where I sit, it appears he should have spent more time with those who are likely voters and convince them of his vision.”

The second race, another that was supposed to be “neck and neck,” was the historic race for City Attorney. If there had ever been a contested election for the office, no one could recall it. Robert Rushing, who took office in 2023 after running unopposed the previous year, found himself with an opponent in Ryan Wolf. The position, which is considered part-time, pays a little more than $22,000 annually. Which begged the question of why someone with a law degree would spend so much time, energy, and money running for that role? Political Strategist Noah Blankenship watched South Arkansas Now’s live stream of the political debate in preparation for this story. Blankenship, who has advised U.S. Senators, Congressmen, Governors, and Presidents, said, “I think that was a question on every voter’s mind. They looked at this relative newcomer who inserted himself into local politics. There’s nothing wrong with that. Frankly, it’s admirable in many circles. But when you come out of nowhere and you jump with both feet into a race for a job that pays below the national poverty line, people ask themselves why. I think Mr. Wolf was damaged most by the debate you hosted and streamed online. His refusal to deny that he was told to run for office or that someone else was pulling his strings was the first red flag. I think the second warning sign was that he proudly stated on six occasions that he would do whatever the Mayor and City Council told him to do. As an outsider looking in, I was taken aback by that statement the first time he said it. Then to go and proudly reannounce five more times seemed amateur and foolish. Finally, I think his statement about running Dollar General Stores gave voters a sour taste. Look, we all love the people at our Dollar General, I know I do. However, that doesn’t mean you want them babysitting your kids, pastoring your church or keeping your city within the law.” Blankenship said.

At the end of the night, Robert Rushing retained his nomination from the party to represent them in the upcoming General Election in November. Rushing ended the night with 679 votes to Wolf’s 475 or a 59% – 41% split.

The third race that was on the radar, but no one could confidently call ahead of time was the “Access for Life” ½ cent sales tax. The proposed tax would be for maintenance and facilities at South Arkansas Regional Hospital. “I think the overall thought was it would pass, but no one knew by what margin. Talking to voters after they left the polls, they expected it to be a very close race.” Grant Merrill, co-owner of South Arkansas Now, said. Blankenship looked over the results and said, “Of course, I’m not in El Dorado. I’m sitting in my office in Austin, Texas. So, I don’t have a finger on the pulse. But I must admit, this one surprised me a little. I fully expected it to pass. I was thinking it would garner 57, maybe 58 percent of the vote. But congratulations to the people who put that campaign together; they obviously attacked that strategically. But let me say this, and I think this is the most important take from this election. Neighbors aren’t talking to each other. There is no reason people should be saying the mayoral race is a coin flip, and he wins with 74% of the vote. There had to be a disconnect. And it’s not just there; we are seeing this around the nation in the races we are working; people are not discussing their votes with their neighbors, churchgoers, co-workers or anyone else. That leaves a void on the public’s sentiment, and I think that’s what we just witnessed in three key races in El Dorado.” The final count on the Access for Life tax was 1371 in favor to 673 opposed.

In other races, Jill Weinischke easily handled challenger Shane Calaway, 249-122, to remain the Republican nominee for El Dorado City Council Ward One. In the Smackover-Norphlet School Board race, Derrick Goodwin defeated Cliff Preston 55-40. The Union County Justice of the Peace race for District 8, between Adam Robertson and Randy Hendricks was decided with Robertson winning 171-99. Union County Circuit Clerk winner Tonya Bass-Allen was easily the highest vote gaining candidate of the night, defeating Kelly McWilliams Ward 1964-805. The race for Union County Assessor between Misti Rawls-Conley and Carrie Langley was slightly closer, with Langley winning by a vote of 1493-1214.

The General Election in November will see races for El Dorado Mayor, City Attorney, as well as City Council seats in Wards 1, 2, and 3.

News

Election Watch 2026 To Air After Polls Close

EL DORADO — South Arkansas Now will provide comprehensive Election Watch coverage Tuesday night as polls close across the state and results begin to come in from local and statewide races.

Polls are scheduled to close at 7:30 p.m., at which point South Arkansas Now’s live election broadcast will begin. Coverage will be available on Facebook Live, YouTube, and SouthArkansasNow.com, bringing viewers real-time results, analysis, and interviews throughout the evening.

Local election night coverage will be anchored at FayRay’s, where Sandy Sanford, Jax Sanford, and JW Misenheimer will be on site tracking local races as results are reported. The team will conduct interviews with local candidates as numbers come in and races are decided, offering viewers immediate reaction and insight from those on the ballot.

Meanwhile, Grant Merrill will provide ongoing coverage of statewide results, monitoring key races and reporting vote totals as they are released. Merrill will also conduct interviews with state leaders and the winners of state races, while offering commentary and analysis alongside some of Arkansas’ top political personalities as the night unfolds.

South Arkansas Now’s Election Watch coverage is designed to give viewers both the local perspective and the broader statewide picture, combining on-the-ground reporting with live updates and expert insight.

Coverage will begin promptly at 7:30 p.m. and continue throughout the evening as results are finalized, making South Arkansas Now a central source for election night information across the region.

News

SouthArk Implements “One Pill Can Kill” Initiative

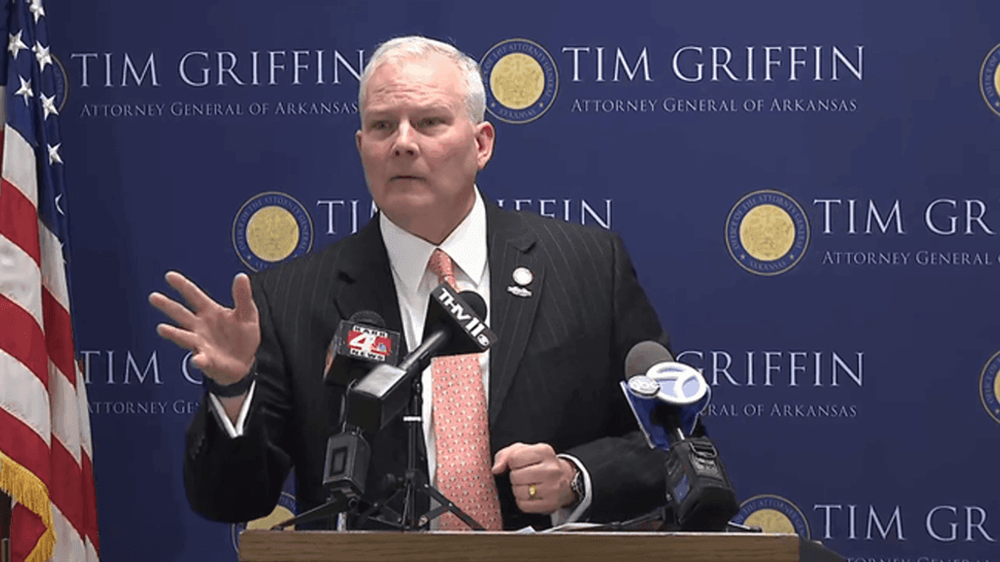

EL DORADO — Arkansas Attorney General Tim Griffin launched the One Pill Can Kill initiative at South Arkansas College this week, marking the first time the program has been introduced at a community college in the state.

South Arkansas College is the ninth school overall to join the initiative, which focuses on educating students about the dangers of opioids, particularly fentanyl, and providing training on how to recognize and respond to overdoses.

“South Arkansas College is the ninth school overall and the first community college to join the One Pill Can Kill initiative,” Griffin said. “I applaud SAC’s leadership for joining this important effort.”

Griffin said the program is designed to address the growing impact of opioids on young adults, a demographic he said is statistically at higher risk.

“While opioids, particularly fentanyl, pose an acute risk to all Arkansans, statistically we know that young adults are disproportionately affected by these dangerous drugs,” Griffin said. “That’s why we’re bringing this program to college campuses across the state. We’re raising awareness and equipping students with information and tools to prevent and mitigate overdoses.”

The initiative emphasizes peer training and education, teaching students about the risks of using unknown substances and how to respond in emergency situations. According to Griffin, the program has already reached a significant number of students statewide.

“Since launching the One Pill Can Kill initiative in the fall of 2024, we have trained approximately 1,450 college students to understand the very real danger of using unknown substances and know what to do if someone near them experiences an overdose,” Griffin said.

South Arkansas College President Stephanie Tully-Dartez said the program aligns with the college’s commitment to student safety and community well-being.

“The risks to young people associated with fentanyl and counterfeit pills are of great concern to our community and especially to those who serve high-risk populations like college students,” Tully-Dartez said. “The One Pill Can Kill initiative raises awareness through peer training and provides a solid and sustainable approach to leveraging campus leadership in the fight against opioids.”

College officials said the program will help empower students with life-saving knowledge while strengthening prevention efforts on campus as opioid-related overdoses continue to impact communities across Arkansas.

News

El Dorado Student Musicians Take Top Honors At Recent Contest

EL DORADO — Student musicians from the El Dorado School District earned top honors this week, marking a successful and celebratory day for the district’s public school music programs.

El Dorado’s Chamber Singers and Oratorio Singers both received Superior Division I ratings for their stage performances and sight-reading, the highest marks awarded at the event. The ratings reflect excellence in musical preparation, technical skill, and overall performance quality.

In addition to their own achievements, the high school ensembles also served as a supportive audience for the Barton Junior Choir, continuing a tradition of mentorship and encouragement across grade levels within the district’s music programs.

Under the direction of Mrs. Langley, the Barton Junior Choir also earned Superior ratings, adding to what district officials described as a standout day for El Dorado’s music students.

The results highlighted the strength of El Dorado’s choral programs and the dedication of both students and instructors, showcasing the district’s continued commitment to arts education.

District leaders praised the performances as a reflection of hard work, collaboration, and a shared culture of excellence across El Dorado Public Schools.

-

News5 months ago

News5 months agoOne Killed In South Arkansas Crash

-

News6 months ago

News6 months agoEl Dorado Man Killed In US 82 Accident

-

News1 year ago

News1 year agoEl Dorado man killed in single vehicle crash

-

News2 months ago

News2 months agoBREAKING NEWS: President Trump Nominates Union County Man To Federal Bench

-

Regional News9 months ago

Regional News9 months agoUnlicensed Teen, Adult Relative Charged With Manslaughter In 150 MPH Fatal Crash

-

Regional News1 year ago

Regional News1 year agoRadio DJ known as “Roy D. Mercer” passes away Friday

-

Obituaries11 months ago

Obituaries11 months agoParker Hammett, Addis LA

-

News8 months ago

News8 months agoSouth Arkansas Woman Killed In Single Car Crash