News

Junction City School District Encourages Precautions Amid Spread of Illness

JUNCTION CITY – The Junction City School District is urging students, staff, and parents to help minimize the spread of several contagious illnesses currently affecting the community and schools. With attendance being important for student learning, the district emphasizes that health and well-being must take priority to ensure children can fully participate in school activities.

To stop the spread of illness, the district recommends the following measures:

- Keep Sick Children at Home: If your child is experiencing symptoms of an illness that could spread, it’s best to keep them home until they’re well.

- Fever-Free Policy: Students should remain at home until they have been fever-free for at least 24 hours without the use of medications like Tylenol or Motrin.

- Vomiting and Diarrhea: Children experiencing these symptoms should stay home until they’ve been episode-free for at least 24 hours.

- Hygiene Practices: Teach and remind children to wash their hands frequently and cover their mouth and nose when coughing or sneezing.

- Rest and Nutrition: Encourage children to get adequate rest and eat healthy, balanced meals to support their immune systems.

The district understands the challenge of deciding when to send a child to school or keep them home but encourages parents to prioritize their child’s ability to learn and participate fully. By working together, the community can help reduce the spread of illnesses and keep schools a safe and healthy environment for everyone.

For more information, parents are encouraged to contact the Junction City School District office.

News

Father Bob Allen Charitable Clinic announces new APRN

News

“CLOSE RACES” END AS LANDSLIDES

EL DORADO – South Arkansas Now spent the last two weeks speaking to people as they exited the early voting location at the El Dorado Municipal Auditorium. Those who spoke with us were promised three things: 1) We would not ask their name, 2) We would NOT ask them for whom they voted and 3) What were their predictions on certain races. The consensus among those we spoke with, leading up to yesterday’s tallying of the votes was, “It’s a toss-up!” “I’d say 50/50!” and one man suggested, “Flip a coin, that’s gonna be about as accurate as trying to predict it at this point.” Each participant said they knew who they voted for but had no idea how the rest of the city would vote.

You may be asking yourself, “Which race are you talking about?” Which is a very good question, because those responses above are all from three different races and yet were most answers we received when talking about 1) The Mayor’s Race, 2) City Attorney’s Race, and the 3) ½ cent sales tax. Prior to going live with last night’s coverage of election returns, B.A. “Sandy” Sanford, Grant Merrill and Jax Sanford all seemed to agree on one key point; it could be a long night if the votes are close.

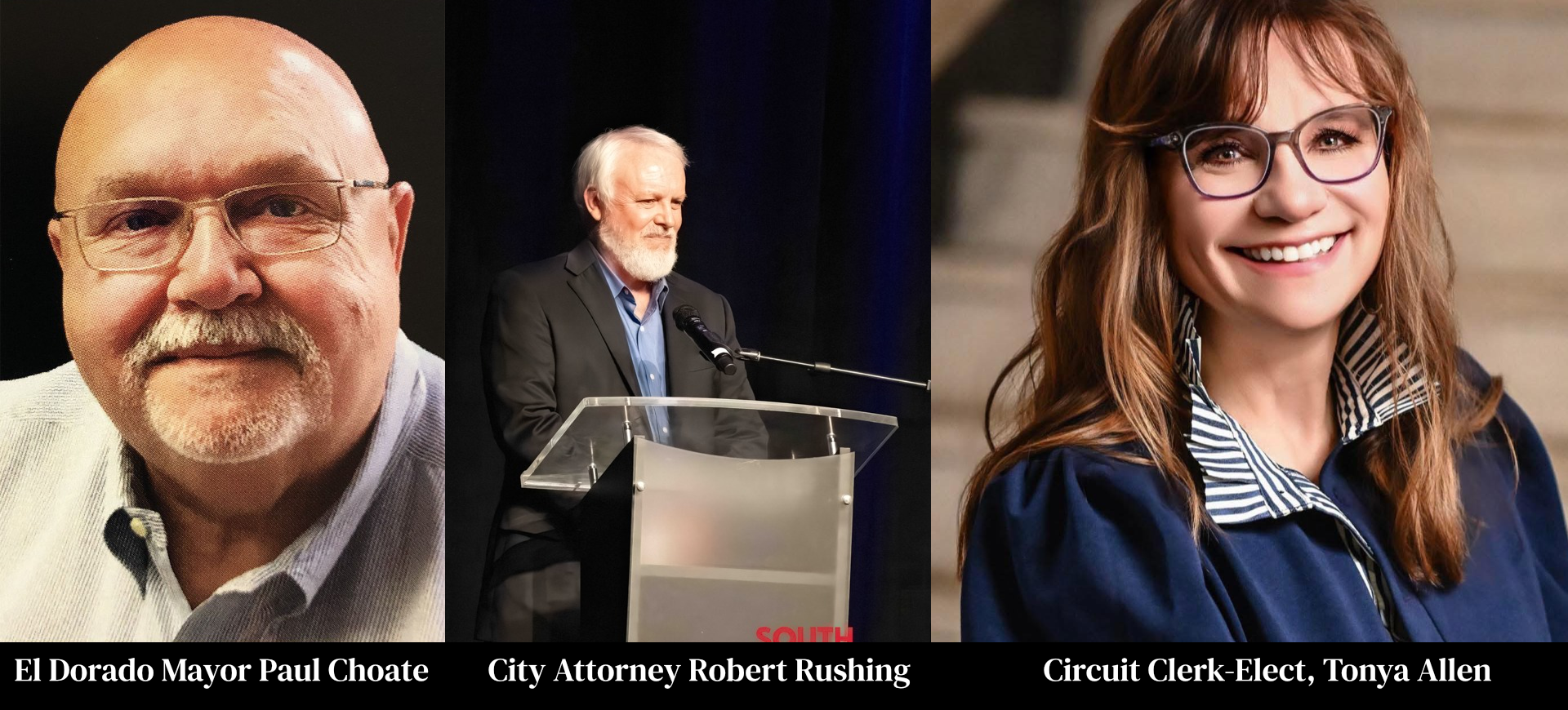

However, once the totals began to roll in, it was anything but close in all three of those races. Mayor Paul Choate, who took office in 2023 after defeating previous Mayor Veronica Smith-Creer, was on the ballot with a Republican challenger in political newcomer Reko Roberson. Voters we spoke with seemed to expect a close race. However, Mayor Choate retained the nomination with 74% of the vote, a count of 875 to Roberson’s 307. Daniel Roberts, a political strategist with ties to Northwest Arkansas, Northeast Louisiana, and the DFW Metro said, “I only have limited knowledge of that race, but from what I saw, Roberson spent most of his time reaching out and trying to include people who were not likely to vote in the Republican primary. From where I sit, it appears he should have spent more time with those who are likely voters and convince them of his vision.”

The second race, another that was supposed to be “neck and neck,” was the historic race for City Attorney. If there had ever been a contested election for the office, no one could recall it. Robert Rushing, who took office in 2023 after running unopposed the previous year, found himself with an opponent in Ryan Wolf. The position, which is considered part-time, pays a little more than $22,000 annually. Which begged the question of why someone with a law degree would spend so much time, energy, and money running for that role? Political Strategist Noah Blankenship watched South Arkansas Now’s live stream of the political debate in preparation for this story. Blankenship, who has advised U.S. Senators, Congressmen, Governors, and Presidents, said, “I think that was a question on every voter’s mind. They looked at this relative newcomer who inserted himself into local politics. There’s nothing wrong with that. Frankly, it’s admirable in many circles. But when you come out of nowhere and you jump with both feet into a race for a job that pays below the national poverty line, people ask themselves why. I think Mr. Wolf was damaged most by the debate you hosted and streamed online. His refusal to deny that he was told to run for office or that someone else was pulling his strings was the first red flag. I think the second warning sign was that he proudly stated on six occasions that he would do whatever the Mayor and City Council told him to do. As an outsider looking in, I was taken aback by that statement the first time he said it. Then to go and proudly reannounce five more times seemed amateur and foolish. Finally, I think his statement about running Dollar General Stores gave voters a sour taste. Look, we all love the people at our Dollar General, I know I do. However, that doesn’t mean you want them babysitting your kids, pastoring your church or keeping your city within the law.” Blankenship said.

At the end of the night, Robert Rushing retained his nomination from the party to represent them in the upcoming General Election in November. Rushing ended the night with 679 votes to Wolf’s 475 or a 59% – 41% split.

The third race that was on the radar, but no one could confidently call ahead of time was the “Access for Life” ½ cent sales tax. The proposed tax would be for maintenance and facilities at South Arkansas Regional Hospital. “I think the overall thought was it would pass, but no one knew by what margin. Talking to voters after they left the polls, they expected it to be a very close race.” Grant Merrill, co-owner of South Arkansas Now, said. Blankenship looked over the results and said, “Of course, I’m not in El Dorado. I’m sitting in my office in Austin, Texas. So, I don’t have a finger on the pulse. But I must admit, this one surprised me a little. I fully expected it to pass. I was thinking it would garner 57, maybe 58 percent of the vote. But congratulations to the people who put that campaign together; they obviously attacked that strategically. But let me say this, and I think this is the most important take from this election. Neighbors aren’t talking to each other. There is no reason people should be saying the mayoral race is a coin flip, and he wins with 74% of the vote. There had to be a disconnect. And it’s not just there; we are seeing this around the nation in the races we are working; people are not discussing their votes with their neighbors, churchgoers, co-workers or anyone else. That leaves a void on the public’s sentiment, and I think that’s what we just witnessed in three key races in El Dorado.” The final count on the Access for Life tax was 1371 in favor to 673 opposed.

In other races, Jill Weinischke easily handled challenger Shane Calaway, 249-122, to remain the Republican nominee for El Dorado City Council Ward One. In the Smackover-Norphlet School Board race, Derrick Goodwin defeated Cliff Preston 55-40. The Union County Justice of the Peace race for District 8, between Adam Robertson and Randy Hendricks was decided with Robertson winning 171-99. Union County Circuit Clerk winner Tonya Bass-Allen was easily the highest vote gaining candidate of the night, defeating Kelly McWilliams Ward 1964-805. The race for Union County Assessor between Misti Rawls-Conley and Carrie Langley was slightly closer, with Langley winning by a vote of 1493-1214.

The General Election in November will see races for El Dorado Mayor, City Attorney, as well as City Council seats in Wards 1, 2, and 3.

News

Election Watch 2026 To Air After Polls Close

EL DORADO — South Arkansas Now will provide comprehensive Election Watch coverage Tuesday night as polls close across the state and results begin to come in from local and statewide races.

Polls are scheduled to close at 7:30 p.m., at which point South Arkansas Now’s live election broadcast will begin. Coverage will be available on Facebook Live, YouTube, and SouthArkansasNow.com, bringing viewers real-time results, analysis, and interviews throughout the evening.

Local election night coverage will be anchored at FayRay’s, where Sandy Sanford, Jax Sanford, and JW Misenheimer will be on site tracking local races as results are reported. The team will conduct interviews with local candidates as numbers come in and races are decided, offering viewers immediate reaction and insight from those on the ballot.

Meanwhile, Grant Merrill will provide ongoing coverage of statewide results, monitoring key races and reporting vote totals as they are released. Merrill will also conduct interviews with state leaders and the winners of state races, while offering commentary and analysis alongside some of Arkansas’ top political personalities as the night unfolds.

South Arkansas Now’s Election Watch coverage is designed to give viewers both the local perspective and the broader statewide picture, combining on-the-ground reporting with live updates and expert insight.

Coverage will begin promptly at 7:30 p.m. and continue throughout the evening as results are finalized, making South Arkansas Now a central source for election night information across the region.

News

SouthArk Implements “One Pill Can Kill” Initiative

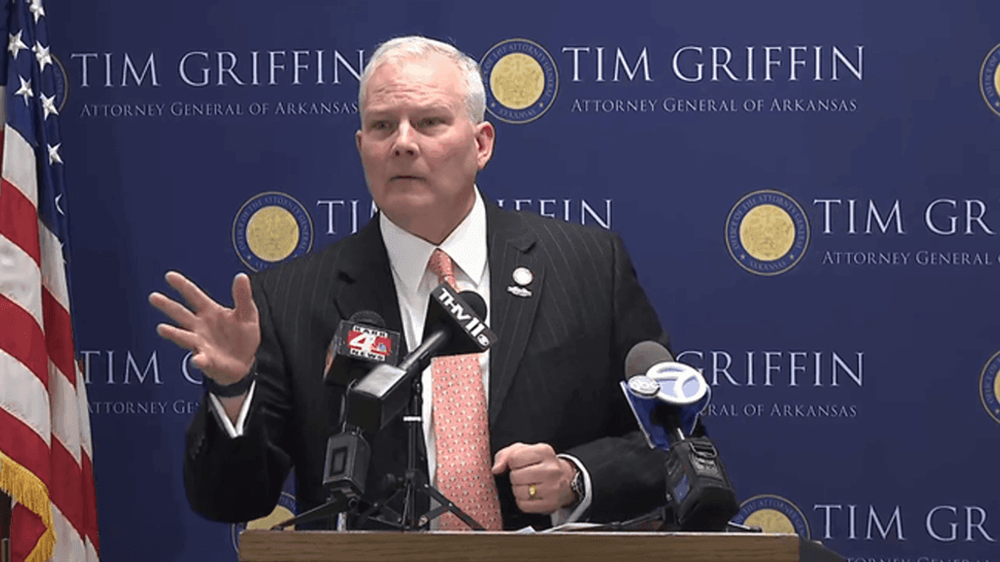

EL DORADO — Arkansas Attorney General Tim Griffin launched the One Pill Can Kill initiative at South Arkansas College this week, marking the first time the program has been introduced at a community college in the state.

South Arkansas College is the ninth school overall to join the initiative, which focuses on educating students about the dangers of opioids, particularly fentanyl, and providing training on how to recognize and respond to overdoses.

“South Arkansas College is the ninth school overall and the first community college to join the One Pill Can Kill initiative,” Griffin said. “I applaud SAC’s leadership for joining this important effort.”

Griffin said the program is designed to address the growing impact of opioids on young adults, a demographic he said is statistically at higher risk.

“While opioids, particularly fentanyl, pose an acute risk to all Arkansans, statistically we know that young adults are disproportionately affected by these dangerous drugs,” Griffin said. “That’s why we’re bringing this program to college campuses across the state. We’re raising awareness and equipping students with information and tools to prevent and mitigate overdoses.”

The initiative emphasizes peer training and education, teaching students about the risks of using unknown substances and how to respond in emergency situations. According to Griffin, the program has already reached a significant number of students statewide.

“Since launching the One Pill Can Kill initiative in the fall of 2024, we have trained approximately 1,450 college students to understand the very real danger of using unknown substances and know what to do if someone near them experiences an overdose,” Griffin said.

South Arkansas College President Stephanie Tully-Dartez said the program aligns with the college’s commitment to student safety and community well-being.

“The risks to young people associated with fentanyl and counterfeit pills are of great concern to our community and especially to those who serve high-risk populations like college students,” Tully-Dartez said. “The One Pill Can Kill initiative raises awareness through peer training and provides a solid and sustainable approach to leveraging campus leadership in the fight against opioids.”

College officials said the program will help empower students with life-saving knowledge while strengthening prevention efforts on campus as opioid-related overdoses continue to impact communities across Arkansas.

News

El Dorado Student Musicians Take Top Honors At Recent Contest

EL DORADO — Student musicians from the El Dorado School District earned top honors this week, marking a successful and celebratory day for the district’s public school music programs.

El Dorado’s Chamber Singers and Oratorio Singers both received Superior Division I ratings for their stage performances and sight-reading, the highest marks awarded at the event. The ratings reflect excellence in musical preparation, technical skill, and overall performance quality.

In addition to their own achievements, the high school ensembles also served as a supportive audience for the Barton Junior Choir, continuing a tradition of mentorship and encouragement across grade levels within the district’s music programs.

Under the direction of Mrs. Langley, the Barton Junior Choir also earned Superior ratings, adding to what district officials described as a standout day for El Dorado’s music students.

The results highlighted the strength of El Dorado’s choral programs and the dedication of both students and instructors, showcasing the district’s continued commitment to arts education.

District leaders praised the performances as a reflection of hard work, collaboration, and a shared culture of excellence across El Dorado Public Schools.

-

News5 months ago

News5 months agoOne Killed In South Arkansas Crash

-

News6 months ago

News6 months agoEl Dorado Man Killed In US 82 Accident

-

News1 year ago

News1 year agoEl Dorado man killed in single vehicle crash

-

News2 months ago

News2 months agoBREAKING NEWS: President Trump Nominates Union County Man To Federal Bench

-

Regional News9 months ago

Regional News9 months agoUnlicensed Teen, Adult Relative Charged With Manslaughter In 150 MPH Fatal Crash

-

Regional News1 year ago

Regional News1 year agoRadio DJ known as “Roy D. Mercer” passes away Friday

-

Obituaries11 months ago

Obituaries11 months agoParker Hammett, Addis LA

-

News8 months ago

News8 months agoSouth Arkansas Woman Killed In Single Car Crash